Manufacturers Conduct Controlled Experiments with Stable SNPs to Produce Sustainable Adhesives

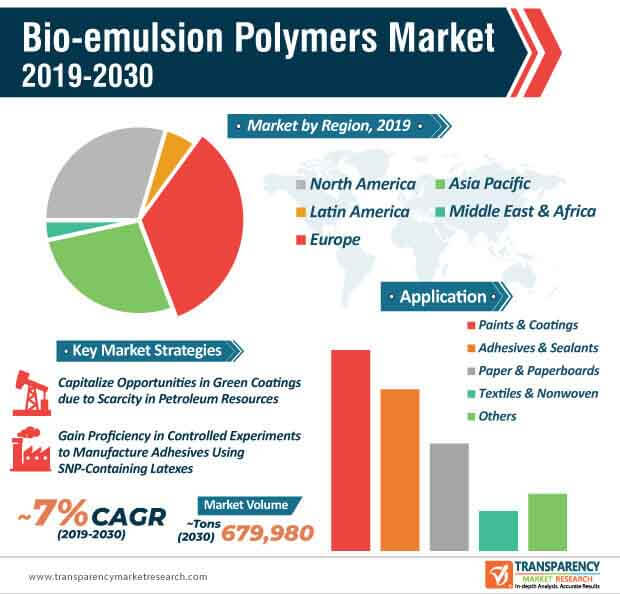

Petroleum resources are a dominant feedstock in polymer production. However, the depletion of petroleum resources has compelled manufacturers to innovate in bio-emulsion polymers. Since bio-emulsion polymers are made from renewable resources, manufacturers are able to abide by environmental regulations regarding petroleum resources. As such, the bio-emulsion polymers market is expected to reach a value of US$ 2 Bn by 2030, as companies are focused in innovations involving experimental grade starch nanoparticles (SNPs) that are being used in adhesive applications.

Renewable chemicals company EcoSynthetix Inc. is gaining proficiency to manufacture adhesives using SNP-containing latexes. The demand for modified SNPs is rising, since these type of SNPs have stable chemical properties in semi-batch emulsion polymerization processes. Companies in the bio-emulsion polymers market are gaining efficiency in controlled experiments to meet growing customer demands for sustainable adhesives.

To gauge the scope of customization in our reports Ask for a Sample

Production of Green Coatings and Paints Help Manufacturers Adhere to Environmental Regulations

Sustainability is one of the key issues that manufacturers are facing in the bio-emulsion polymers market. Growing awareness about environmental regulations is encouraging manufacturers to innovate in low VOC (Volatile Organic Compounds) technologies for paints, sealants, and binders, among others. They are increasing R&D efforts to manufacture green coatings and paints that comply with environmental regulations. In order to achieve this, companies are using water as a continuous phase in several stages of coatings and paints production, owing to the crucial role of innocuous and nonflammable solvent.

Manufacturers are using water for the production of green paints and coatings, since water helps to reduce the reaction medium viscosity and enhances the product’s heat transfer capabilities. Companies in the bio-emulsion polymers market are using vegetable oils and sugar derivatives to yield bio-based latex.

Get an idea about the offerings of our report from Report Brochure

Bio-emulsion Polymers Increasingly Replacing Harmful Acrylates and Styrene Monomers

The demand for energy-efficient bio-emulsion polymers is surging worldwide. This trend is creating value-grab opportunities for manufacturers who are using bio-based and safe chemicals to innovate in adhesives and coatings. As such, the bio-emulsion polymers market is expected to register a CAGR of 7% during the forecast period. Bio-emulsion polymers are pervasively replacing harmful monomers such as acrylates, styrene or isocyanates. However, crucial challenges associated with the substitution of styrene and other harmful petro-based acrylates remain as a drawback for manufacturers. Hence, companies in the bio-emulsion polymers market are acquiring proficiency in experiments that substitute surfactants from petro-based acrylates.

Manufacturers are increasing their production capabilities to develop functional coatings that help to avoid issues of superposition usually associated with conventional class of coatings. Functional coatings are creating economic and environmental advantages for manufacturers.

Explore Transparency Market Research’s award-winning coverage of the global Industry: https://www.prnewswire.co.uk/news-releases/use-of-portable-stoves-with-integrated-butane-gas-cartridges-spur-sales-in-butane-gas-cartridges-market-valuation-to-expand-at-cagr-of-4-from-2019-to-2027-876812900.html

Companies Cater to Business Continuity Plans in Countries with Low Number of COVID-19 Cases

The novel coronavirus (COVID-19) pandemic has caused a crippling effect on the bio-emulsion polymers market. Factory closures are among key factors for slowing down of the bio-emulsion polymers market growth. However, manufacturers are adopting safety measures enlisted by the WHO (World Health Organization) to establish a skeleton team in various departments of companies in order to keep the businesses running. Manufacturers are prioritizing essential projects catering to textiles and nonwoven applications.

Companies are providing their employees and workers with PPE (Personal Protective Equipment) and other preventive gears to contain the spread of the COVID-19. They are investing in thermal thermometers and AI (Artificial Intelligence)-based security cameras to detect workers and employees with elevated temperatures. Manufacturers are focusing on business continuity plans in European countries and China where the novel virus has potentially subsided.

0 Comments